Also available in PDF

INTRODUCTION

Asian Clearing Union (ACU) is a form of payment arrangements whereby the participants settle payments for the transactions among the participating central banks on a multilateral basis.

The main objectives of a clearing union are: to facilitate payments among member countries for eligible transactions, to economize on the use of foreign exchange reserves and transfer costs, to promote trade among the participating countries.

The ACU is a clearing union among other clearing houses/payments arrangements operating in various regions of the world.

ESTABLISHMENT

The ACU was established as an initiative of the United Nation Economic and Social Commission for Asia and the Pacific (UNESCAP). The decision to establish the ACU was taken at the Fourth Ministerial Conference on Asian Economic Cooperation held in December 1970 in Kabul. The Draft Agreement Establishing the ACU was finalized at a meeting of the senior officials of the governments and central banks held at ESCAP Meeting, Bangkok, in December 1974 after five central banks (India, Iran, Nepal, Pakistan, and Sri Lanka) signed the Agreement. Bangladesh and Myanmar were the sixth and seventh signatories to this Agreement. Bhutan signed the Agreement in 1999. As the ninth member, the Maldives joined the ACU in 2009. Belarus and Mauritius, from Europe and Africa, became the ACU members in 2023 and the number of the ACU members reached to eleven.

OBJECTIVES

-

To provide a facility to settle payments, on a multilateral basis, for current international transactions among the participants;

-

To promote the use of participants currencies in current transactions between their respective territories and thereby effect economies in the use of the participants› exchange reserves;

-

To promote monetary cooperation among the participants and closer relation among the banking systems in their territories and thereby contribute to the expansion of trade and economic activity among the

countries of the ESCAP region; and

-

To provide for currency SWAP arrangements among the participants so as to make Asian Monetary Units (AMUs) available to them temporarily.

Goverance

Board of Directors

Each participant appoints one Director and one Alternate Director. The Board elects a Chairman and a Vice-Chairman from among its members. The Board meets at least once a year. All decisions of the Board of Directors are taken by a majority of the votes of all Directors unless a special majority is required by the Agreement.

Secretary General

The Board is authorized to appoint a Secretary General for a term of three years. The Secretary General may be reappointed and shall cease to hold office when the Board so decides.

Agent

The Board of Directors may make arrangements with a central bank or monetary authority of a participant to provide the necessary services and facilities for the operation of the clearing facility. The Board has accepted the offer of the Central Bank of the Islamic Republic of Iran (CBI) to act as the agent for the ACU.

Language

The official language of the ACU is English.

ACU OPERATIONS

Unit of Accounts

The accounts of the Asian Clearing Union shall be kept in «Asian Monetary Units»(viz. ACU dollar, ACU euro, ACU yen and such other currencies including member countries domestic currencies as decided by the Board from time to time) which may be referred to in the abbreviated form as «AMUs».

Settlement Period

The amount which has not been cleared at the end of each two-monthly period needs to settled in a T+4 manner. The settlement of net positions and accrued interests takes place at the end of a two-monthly settlement period. The Board of Directors may change the length of the settlement periods by a decision taken by the unanimous votes of the entire Directors.

Interest

Interest shall be paid by net debtors and transferred to net creditors on daily outstandings between settlement dates. The rate of interest applicable for a settlement period will be the closing rate of the last Monday of the previous calendar month offered by the Chicago Mercantile Exchange Secured Overnight Financing Rate (CME SOFR) term one month for US Dollar, the Euro Interbank Offered Rate (EURIBOR) one month for Euro and the Inter-Continental Exchange (ICE) for one month Japanese Yen deposits.

Membership

· Central bank or monetary authority of each regional member or associate member of UNESCAP is eligible to apply to the Board of Directors to become a participant and be admitted as a participant if the Board so decides by a two-third vote of all the Directors.

· A central bank or monetary authority that is not an UNESCAP member may apply to become a participant and be admitted as a participant if the Board so decides by the unanimous vote of all the Directors.

Upon such central bank or monetary authority signing the Agreement and accepting the rules, regulations and decisions of the Board of Directors, the Chairman of the Board shall determine the date on which the payments and transfers with respect to such a participant shall be included in the clearing facility.

Composition

At present, the ACU enjoys the membership of the following participants:

Bangladesh Bank

National Bank of the Republic of Belarus

Royal Monetary Authority of Bhutan

Reserve Bank of India

Central Bank of the Islamic Republic of Iran

Maldives Monetary Authority

Bank of Mauritius

Central Bank of Myanmar

Nepal Rastra Bank

State Bank of Pakistan

Central Bank of Sri Lanka

Relations with Other Organizations and Clearing Arrangements

There is no prohibition for the participants to cooperate with other general, regional or sub-regional international organizations or other payment arrangements among countries within or outside the ESCAP region.

Currency Swap Arrangement

The main objective of the SWAP arrangement is to extend short-term foreign exchange support by providing participants access to the international reserves of other participants in times of temporary liquidity problems.

The potential benefits of the SWAP facility are:

· Easy access by participants to international reserves of other participants at a time when foreign exchange support is needed:

· Availability of the facility on a multilateral basis rather than on a bilateral basis; and

· The opportunity for further monetary cooperation among the participants.

ACU ACHIEVEMENTS

Rapid Expansion of Trade

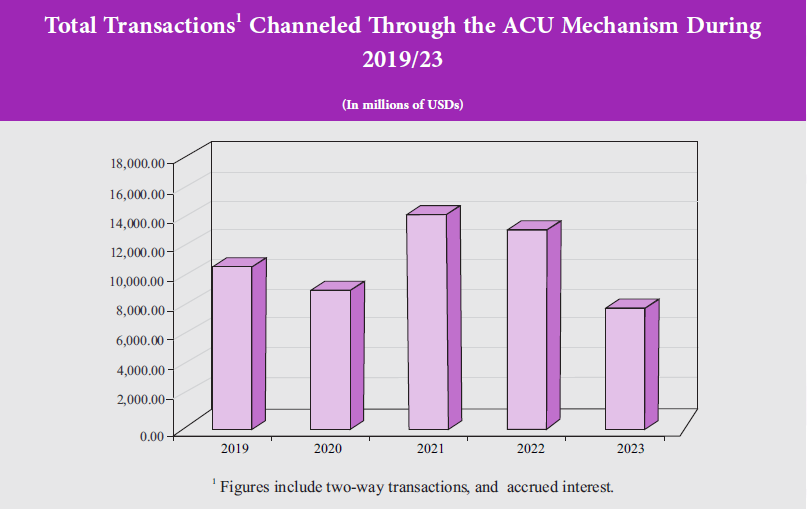

· ACU transactions experienced an upward trend since the inception of the ACU (1975). Notable increase in the volume of transactions from USD 51.44 million in 1976 to USD 16,171.72 million in 2023 well advocates the claim.

· In 2023, volume of transactions reached USD 16,171.72 million with 39.49 percent negative growth compared to the preceding year.

· On a monthly basis, the average transactions stood at USD 1,347.64 million, depicting 39.49 percent negative growth over the last year (2022).

· India (46.74 percent), Bangladesh (46.23 percent), Pakistan (3.74 percent), and the Maldives (1.92 percent), represented the highest share in total transactions, respectively.

No Default

Under the ACU Procedure Rules, the debtor participants shall pay their dues in convertible currencies within four working days of the receipt of the notice of payment from the Secretary General. The experience of the ACUs operations from the inception to date proves that this requirement has been solemnly fulfilled by each participant on each and every occasion. There has been no default by any participant so far in honoring its obligation for the settlement of its net position within the stipulated time period. In comparison to other clearing arrangements among developing countries, the achievement of «zero default› is a landmark of the success of the ACU.

GENERAL PUBLICATIONS

· Annual Report of the ACU is published once a year with the approval of the Board of Directors.

· Monthly Newsletters are published at the beginning of the month. Outlining the activities and operations of the ACU in the preceding month.

COMMUNICATIONS

For any further information or enquiries, please contact at the following address:

Secretary General

Asian Clearing Union

(Secretariat)

|

|

|

Address:

|

No. 2, Parvin Alley, South Saleh Hosseini St., Hojat Sori Str., Yarmohammadi Str., Shahrzad Blvd., Pasdaran Str. Tehran, I.R. of Iran, P.O. Box: 15875/7177 Tehran I.R. Iran

|

|

Tel:

|

+98 21 22783951, +98 21 22792520

|

|

Fax:

|

+98 21 22558605 |

| E-mail: |

acusecret@cbi.ir |

|

Swift:

|

BMJIIRTHACU

|

|

Telex:

|

088 21 3120, 088 21 6868

|

|

Cable:

|

ACUNION IR

|

|

Website:

|

www.asianclearingunion.org

|

TOP